Renting vs Buying a Home in Lubbock TX: How to Decide

If you’re weighing the pros and cons of renting vs buying a home in Lubbock TX, you’re in the right place. I’m Andrew Baxter from Living in Lubbock Texas, and in this guide I’ll walk you through the market realities, the financial math, the lifestyle trade-offs, and the practical steps to make the decision that fits your life. Whether you’re relocating here, starting a family, or trying to lock down your financial future, this is the real talk on renting vs buying a home in Lubbock TX—straightforward, anecdotal, and numbers-driven.

Table of Contents

- Why the Rent vs Buy Decision Matters in Lubbock, TX

- Lubbock Housing Market Snapshot

- Cost Breakdown: Renting vs Buying a Home in Lubbock, TX

- Lubbock Rental Market Overview: Apartments, Houses, Duplexes

- Building Long-Term Wealth Through Homeownership in Lubbock

- Flexibility and Freedom — Why Renting Still Makes Sense for Some

- What to Expect in Lubbock Communities

- The Hidden Costs of Homeownership

- Rent or Buy? A Quick Decision Checklist for Lubbock Residents

- Next Steps If You’re Thinking About Buying a Home in Lubbock, TX

- Next Steps If You’re Planning to Rent in Lubbock, TX

- Common Myths About Renting vs Buying a Home in Lubbock, TX

- FAQs About Buying vs Renting in Lubbock, TX

- Final thoughts — How I Help Clients Decide Between Renting and Buying in Lubbock

- Need Personalized Help with Your Lubbock Housing Decision?

Why the Rent vs Buy Decision Matters in Lubbock, TX

Choosing between renting vs buying a home in Lubbock TX isn’t just a lifestyle pick—it's a financial decision that can have ripple effects for years. Lubbock is a market with strong rental demand and increasing costs in property taxes and insurance, so monthly housing payments—whether rent or mortgage—matter a lot. My goal here is simple: give you the context and the calculations so you can make an informed choice that fits your timeline, savings, and comfort level.

Lubbock Housing Market Snapshot

Over the last few years Lubbock has seen steady demand for housing, both for purchases and for rentals. Supply and demand dynamics in Texas—especially in secondary markets that are growing—mean landlords have been able to raise rents, and buyers have experienced price appreciation over time. But there’s more to the story: property taxes and homeowners insurance in Texas have climbed sharply. That directly affects housing costs whether you’re a landlord setting a new rent or a homeowner paying an escrowed tax bill.

To illustrate with a real example from my portfolio: a four-bedroom house I rented for $2,200 one year was rented the next year for $2,300. It’s easy to point a finger and call that a “greedy landlord” move, but when property taxes increase and insurance premiums jump, the owner’s monthly carrying costs rise and rents follow suit. That’s the new normal in many Texas markets—and it’s a key reason to consider if renting vs buying a home in Lubbock TX makes sense for you.

Key takeaway

Rent increases in Lubbock are driven by higher operating costs (taxes and insurance) and continued demand for housing. If you’re wondering whether to continue renting or shift toward ownership, factor in these trends.

Cost Breakdown: Renting vs Buying a Home in Lubbock, TX

Let’s do the math—this is the part where a lot of people make a decision emotionally, but you can make it logically. If you’re comparing renting vs buying a home in Lubbock TX, you should compare the monthly outflow for rent against the total monthly cost of owning (principal + interest + taxes + insurance + HOA if applicable).

Example mortgage scenario (real, conservative numbers)

- Purchase price: $250,000

- Loan: 30-year fixed

- Down payment: 10% ($25,000)

- Interest rate example: 6.3%

- Principal & interest: ~ $1,400/month

- Property taxes: ~ $387/month

- Homeowner’s insurance: ~ $200/month

- Estimated total monthly payment: $2,000–$2,100

Those numbers are conservative and localized. In the example above, a buyer putting 10% down on a $250,000 house at a 6.3% rate ends up with a monthly housing cost similar to many rental payments in Lubbock. That’s the pivot point: when the monthly mortgage + taxes + insurance aligns closely with local rents, long-term ownership can build equity while renting just pays the landlord.

Financing options and down payment considerations

Not everyone has $25,000 sitting around. The good news: FHA loans allow as little as 3.5% down for qualified buyers, which greatly lowers the initial cash outlay for entry-level homebuyers. If you’re serious about buying and you can save for a year or two to meet down payment and closing costs, you may find that buying beats renting over a 5–10 year horizon—especially if your monthly payments are comparable to rent.

Lubbock Rental Market Overview: Apartments, Houses, Duplexes

Rent options in Lubbock vary a lot based on location, age of the property, and amenities. Below are ballpark ranges that I see commonly in Lubbock:

- One-bedroom apartments: $500–$1,100 (older units at the low end; newer at the higher end)

- Two-bedroom apartments: $750–$1,200+

- Three-bedroom units (less common as apartments): variable, but often in the $900–$1,400 range

- Single-family houses (3–4 bed): typically $2,000–$2,600 depending on neighborhood and condition

- New duplex sides: commonly $1,300–$1,500

For many renters, you can find a comfortable one- or two-bedroom apartment for a fraction of the mortgage example above. But remember: a single-family house with a comparable square footage can be similar in monthly cost. When you compare renting vs buying a home in Lubbock TX, don’t forget to match amenities, commute times, and school districts in your comparison.

Building Long-Term Wealth Through Homeownership in Lubbock

If your plan is to stay in Lubbock more than five to ten years, buying often becomes a powerful wealth-building tool. Every mortgage payment reduces principal a little bit, and over years that becomes equity. If home values appreciate (as they often do in growing secondary markets), you further benefit from appreciation on top of amortization.

Buying is not guaranteed to make you rich overnight, but if your monthly mortgage payment is close to what you’d pay in rent, ownership shifts that monthly cash from your landlord’s balance sheet into your own. The compounding effect over a decade can be significant.

When buying makes the most sense

- You plan to stay in Lubbock for 5+ years (ideally 10+ years).

- Your monthly mortgage + taxes + insurance is similar to local rent for a comparable property.

- You have a down payment saved or can access a low-down loan program and still have an emergency fund.

When those things line up, I almost always recommend buying over renting. That’s why many of the people I’ve helped move to Lubbock chose to buy.

Flexibility and Freedom — Why Renting Still Makes Sense for Some

Not everyone should buy. Renting has real advantages:

- Flexibility: easier to relocate for a job, relationship, or other life changes.

- Fewer maintenance responsibilities: landlord typically handles repairs and major system failures.

- No large upfront cash outlay: rent doesn’t require down payment and closing costs.

- Less risk if you expect to move within 1–2 years.

If you’re moving to Lubbock from out of state and unsure about neighborhoods, renting provides time to get your bearings. That said, do your homework before signing a lease. I’ve seen people excited about an $800 rental only to find the neighborhood or the unit isn’t what they thought. Realtors often don’t make big commissions on rentals in Lubbock, so property managers control many listings—do your research and ask for neighborhood info before you commit.

When renting makes the most sense

- You plan to be in Lubbock for only 1–2 years.

- You don’t have a down payment saved or you prefer to keep liquid cash for other goals.

- You value a landlord handling repairs and don’t want maintenance responsibilities.

- You need maximum mobility for work or family reasons.

What to Expect in Lubbock Communities

People often ask me about HOAs in Lubbock. Some folks hate them; others don’t mind the small monthly fee for neighborhood upkeep and amenities. In Lubbock, HOAs commonly offer access to a pool, clubhouse, or landscaping standards. But if you don’t want HOA rules, you can buy outside an HOA. And if amenities matter more than ownership, you can often find rental houses or apartments in communities with pools and shared spaces.

Think through the lifestyle trade-offs: if you care about a backyard, storage, or particular schools like Cooper or Frenship ISD, that might push you toward buying a specific neighborhood even if the monthly costs are slightly higher. If mobility and low commitment matter more, then renting near good transit or close to campus might be preferable.

The Hidden Costs of Homeownership

One of the biggest differences between renting vs buying a home in Lubbock TX is how maintenance costs are handled. If you rent, your landlord covers major repairs—AC failures, plumbing issues, etc. If you own, those expenses come out of your pocket (unless you purchase a home warranty or have savings set aside).

From my experience managing rental properties in Lubbock—about 14 homes—I’ll be blunt: the typical issues are AC and plumbing stuff. Nothing catastrophic on most properties if you do proper inspections and negotiate repairs with sellers before closing. Get a thorough inspection and don’t buy blind. Proper due diligence reduces the chance of big surprise expenses.

How to protect yourself as a buyer

- Always get a home inspection and review findings with a licensed inspector.

- Negotiate seller repairs or credits when warranted.

- Consider a home warranty for the first year to cover major systems (often costs under $1,000/year).

- Keep a maintenance reserve—common guidance is 1%–2% of home value per year for upkeep.

Rent or Buy? A Quick Decision Checklist for Lubbock Residents

Use this checklist to help decide if renting vs buying a home in Lubbock TX makes sense for you:

- Timeline: Will you be in Lubbock for 1–2 years or 5–10+ years?

- Cash: Do you have down payment plus closing costs and an emergency reserve?

- Monthly cost comparison: Is mortgage+taxes+insurance comparable to local rents?

- Maintenance tolerance: Do you want to handle repairs or prefer a landlord?

- Neighborhood & schools: Do you need a specific area based on schools, commute, or amenities?

- Investment mindset: Are you looking for long-term equity appreciation?

Next Steps If You’re Thinking About Buying a Home in Lubbock, TX

If you lean toward buying, here’s a straightforward plan:

- Get pre-approved for a mortgage so you understand your budget and down payment needs.

- Save for down payment and keep some cash liquid for closing and reserves.

- Identify neighborhoods you like and compare comparable rents vs mortgage payments.

- Hire a local agent who knows Lubbock neighborhoods and can represent your interests in negotiation.

- Schedule a home inspection and negotiate repairs or credits as needed.

- Plan long-term: treat the purchase as a 5–10+ year investment unless you’re flipping.

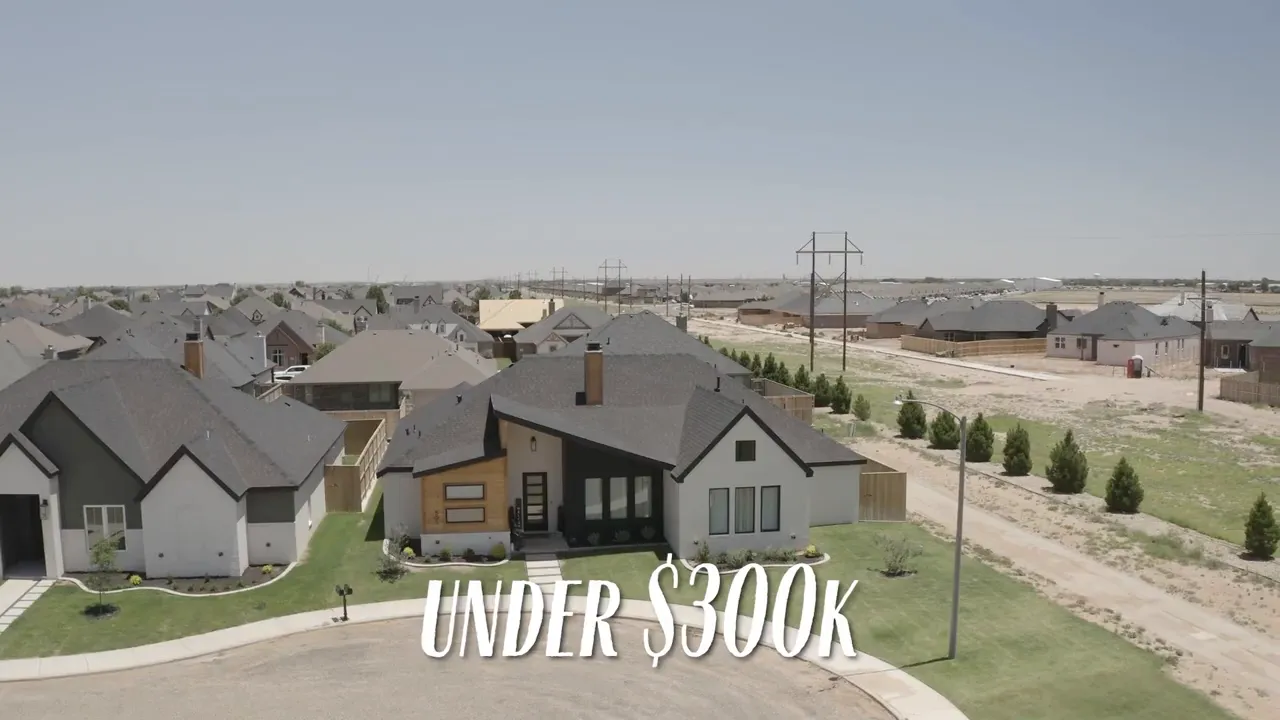

VIEW HOMES FOR SALE IN LUBBOCK, TEXAS

Next Steps If You’re Planning to Rent in Lubbock, TX

If renting feels like the right choice for now:

- Research neighborhoods thoroughly—don’t rely only on an attractive price.

- Ask about average utility costs, crime stats, and property management responsiveness.

- Consider newer duplex units if you want a higher-quality rental around $1,300–$1,500.

- Read lease terms carefully—understand notice periods, pet rules, and security deposit conditions.

- Keep saving toward a down payment if ownership is a future goal.

Common Myths About Renting vs Buying a Home in Lubbock, TX

- Myth: Renting is always cheaper. Reality: In Lubbock the line can blur; some single-family house rents approach mortgage payments.

- Myth: Buying always means massive maintenance headaches. Reality: If you buy right and inspect, typical issues are manageable and often predictable.

- Myth: You must have 20% down to buy. Reality: Programs exist for as low as 3.5% down (FHA) if you qualify.

FAQs About Buying vs Renting in Lubbock, TX

How do I decide between renting vs buying a home in Lubbock TX if my monthly costs are similar?

If monthly mortgage + taxes + insurance is similar to rent, prioritize your timeline and goals. If you plan to stay 5+ years and can afford the down payment and reserves, buying usually makes financial sense because you build equity. If you prioritize mobility or lack a down payment, renting may be a better short-term choice.

Can I buy a home in Lubbock with less than 10% down?

Yes. FHA loans allow as low as 3.5% down for qualified buyers. There are also VA loans (for eligible veterans) with little or no down payment, and some conventional loans with 3% down for first-time buyers. Always compare loan types and mortgage insurance implications.

How much should I expect to pay in rent for a 3–4 bedroom house in Lubbock?

Expect a market range of roughly $2,000 to $2,600 for many 3–4 bedroom homes in established Lubbock neighborhoods. Newer or nicer homes can be higher. Always check local listings and neighborhood comps for current figures.

Are property taxes and insurance going up in Lubbock?

Yes—property taxes and homeowners insurance in Texas have been rising in many areas, which can increase both mortgage escrow payments and the cost for landlords, who may raise rents in response.

If I rent, will I always be throwing money away?

Renting isn’t inherently throwing money away. It pays for housing, flexibility, and reduced responsibility for maintenance. However, if your rent is close to what a mortgage would be and you plan to stay long-term, buying can convert monthly payments into equity over time.

What should I inspect before buying a home in Lubbock?

Get a full home inspection covering structural, plumbing, electrical, HVAC, roof, and foundation. Review past utility bills, pest reports, and any seller disclosures. Negotiate repairs or credits based on inspection findings.

Final thoughts — How I Help Clients Decide Between Renting and Buying in Lubbock

I love buying real estate. I buy rental properties in Lubbock because I believe in the long-term growth of the market and because owning property converts monthly payments into an asset over time. That said, I’m not blind to the very real reasons people rent: flexibility, lower immediate costs, and the convenience of someone else handling repairs.

If you’re trying to decide on renting vs buying a home in Lubbock TX, run the numbers: compare rent to mortgage+tax+insurance, factor in your timeline, and decide how much risk and maintenance you’re willing to take on. If the monthly outflows are similar and you’re planning to stay more than five years, buying tends to be the financial winner. If you need more mobility or don’t have down payment funds, renting is the sensible short-term plan.

Need Personalized Help with Your Lubbock Housing Decision?

If you want to run numbers for your specific situation or get a realistic breakdown of neighborhoods, loan options, and current prices in Lubbock, reach out at (806) 464-9380. I help folks move to Lubbock regularly and I’ll walk you through local comps, what to expect from rents versus mortgages, and how to avoid common pitfalls. Making the right decision on renting vs buying a home in Lubbock TX starts with accurate, local information—so let’s talk.